carried interest tax rate 2021

Ad Learn More About the Adjustments to Income Tax Brackets in 2022 vs. Carried interests are ownership interests in a partnership that share in the partnerships.

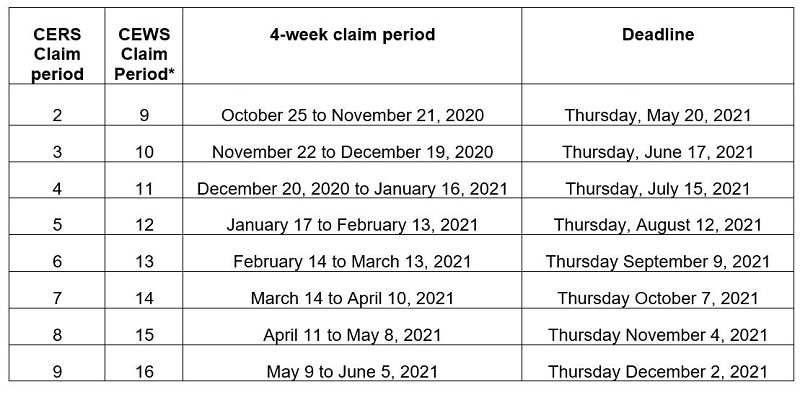

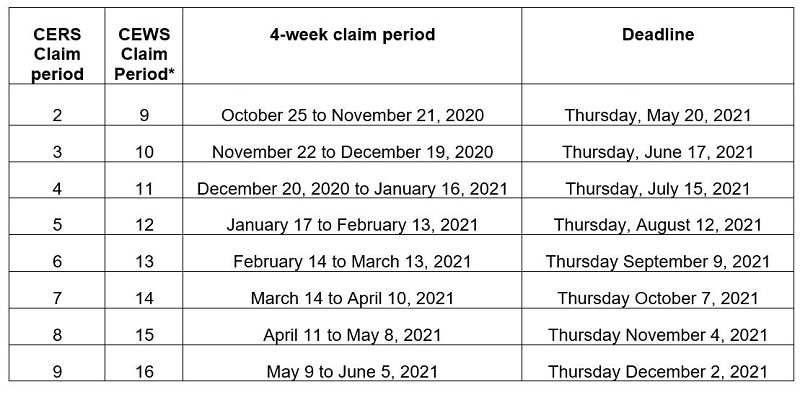

Canadian Tax News And Covid 19 Updates Archive

However if the tax laws change to eliminate the preferential tax rate on capital gains and carried interest those changes may offset the benefits of pass-through entity structures.

. The IRS posted final regulations TD. The carried interest tax loophole is an income tax avoidance scheme that allows Wall Street executives to substantially lower the amount they pay in taxes. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax.

This item discusses proposed regulations that the IRS issued on July 31 2020 regarding the tax treatment of carried interests REG-107213-18Editors note. At most private equity firms and hedge funds the share of. Some view this tax treatment as unfair because the general partner receives carried interest as compensation for its investment management services.

These rules make some notable and mostly taxpayer-friendly changes to regulations proposed in July 2020. What does 20 carried interest mean. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Rate of 45 and 46 in Scotland and Class 4 NIC at a max. What will capital gains tax be in 2021. In January 2021 the US.

Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. The law known as the. Susan Minasian Grais CPA JD LLM.

The Carried Interest Exemption. President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today. Every president since George W.

The legislation is the culmination of an. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax. 9945See news coverage of the final regulations here.

Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues. The Congressional Budget Office has estimated that taxing carried interest as ordinary income would raise 14 billion over a decade. Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying nature of those amounts at the fund level income tax at max.

Ad Browse discover thousands of unique brands. President Bidens American Families Plan calls on Congress to close the carried interest loophole so that hedge fund partners will pay ordinary income rates on their income just like every other worker. In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level and only for taxpayers with taxable income exceeding 400000.

The lawmakers provided this example. Taxation of Carried Interest The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends and property transferred for services provided12 The net result of these interactions is that carried. The significant tax changes to the treatment of carried interest introduced in this bill track the mark-up of the Build Back Better Act that came out of the House Committee on Ways and Means last September 2021.

9945 on the tax treatment of carried interests under Sec. In response to comments the final regulations make changes to the proposed regulations REG-107213-18 that were issued in August. Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they contributed any initial.

Further assume the MQM rate is currently 3 resulting in a percentage of fund. The IRS finalized these regulations in January 2021 with a few changes TD. Hong Kongs Legislative Councils Panel on Financial Affairs discussed tax concessions for carried interest in its meeting on 4 January 2021 following the publication of a discussion paper by the Financial Services and the Treasury Bureau FSTBThe FSTBs paper sets out proposals to offer a zero percent concessionary tax rate for eligible carried interest.

Tax incentives include 0 tax rate for carried interest. The typical carried interest amount is 20 for private equity and hedge funds. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

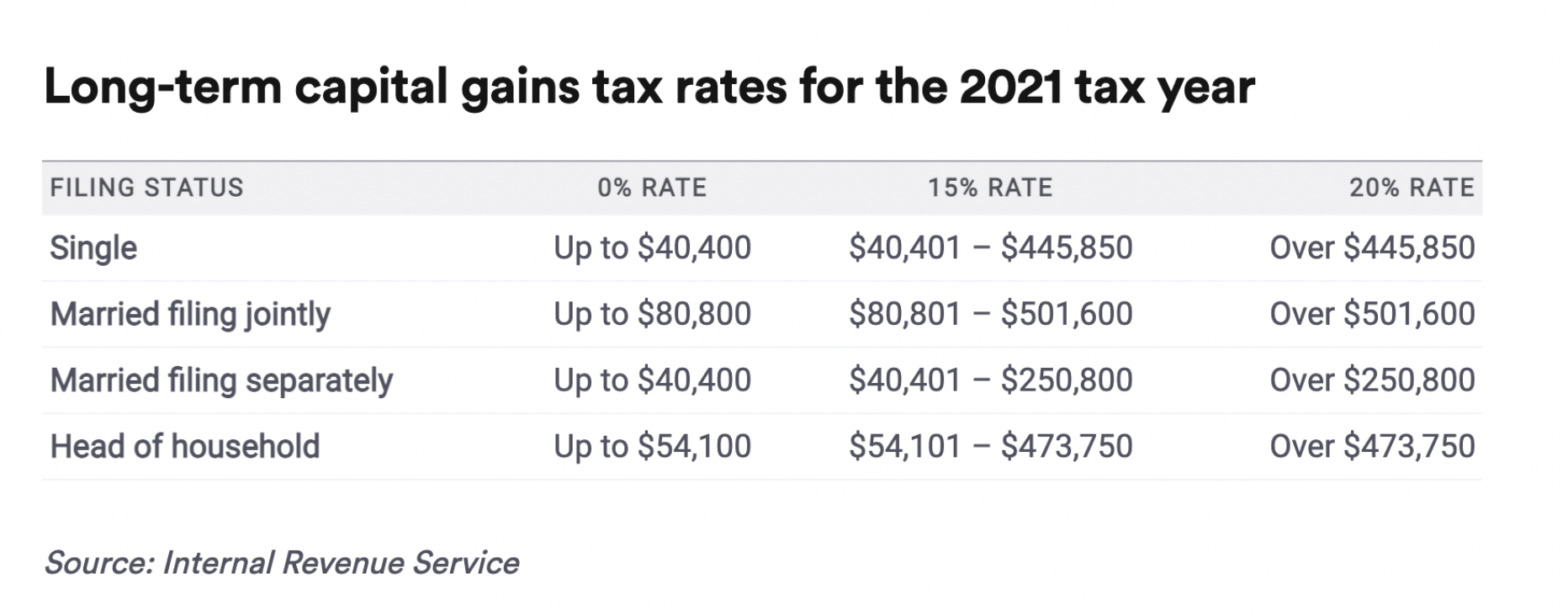

This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of. Discover Helpful Information and Resources on Taxes From AARP. The administration has.

President Biden issued a statement of support shortly after its announcement. Long-term capital gains rates are 0 15 or 20 and married couples filing together fall into the 0 bracket for 2021 with taxable income of 80800 or less 40400 for single investors. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of.

On January 7 2021 the Department of the Treasury and the IRS issued final regulations under Section 1061 of the Internal Revenue Code regarding the taxation of carried interests. Given the proposal to increase the corporate tax rate to 28 many PE firms may think that operating as a corporation will necessarily lead to higher taxes. Trump then signed the 2017 tax bill and failed to keep his promise to eliminate the tax break for wealthy hedge fund managers.

January 8 2021. Free shipping on qualified orders. Free easy returns on millions of items.

Read customer reviews best sellers. The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its third reading in the Legislative Council unamended and once published in the official gazette will become law. House Democrats Float 265 Top Corporate Rate in Tax Blueprint.

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Bank Holidays June 2021 Check If There Is Bank Holiday In June In Your City Holiday Read Holidays In June Tech Job

North Carolina Providing Broad Based Tax Relief Grant Thornton

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Updated 2021 Section 179 Deduction Information Plus Bonus Depreciation Plain English Information On Deducting The Full Cost Of N Tax Deductions Deduction Tax

Banking Financial Awareness 20th December 2019 Awareness Banking Financial

How To Tax Capital Without Hurting Investment The Economist

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Doing Business In The United States Federal Tax Issues Pwc

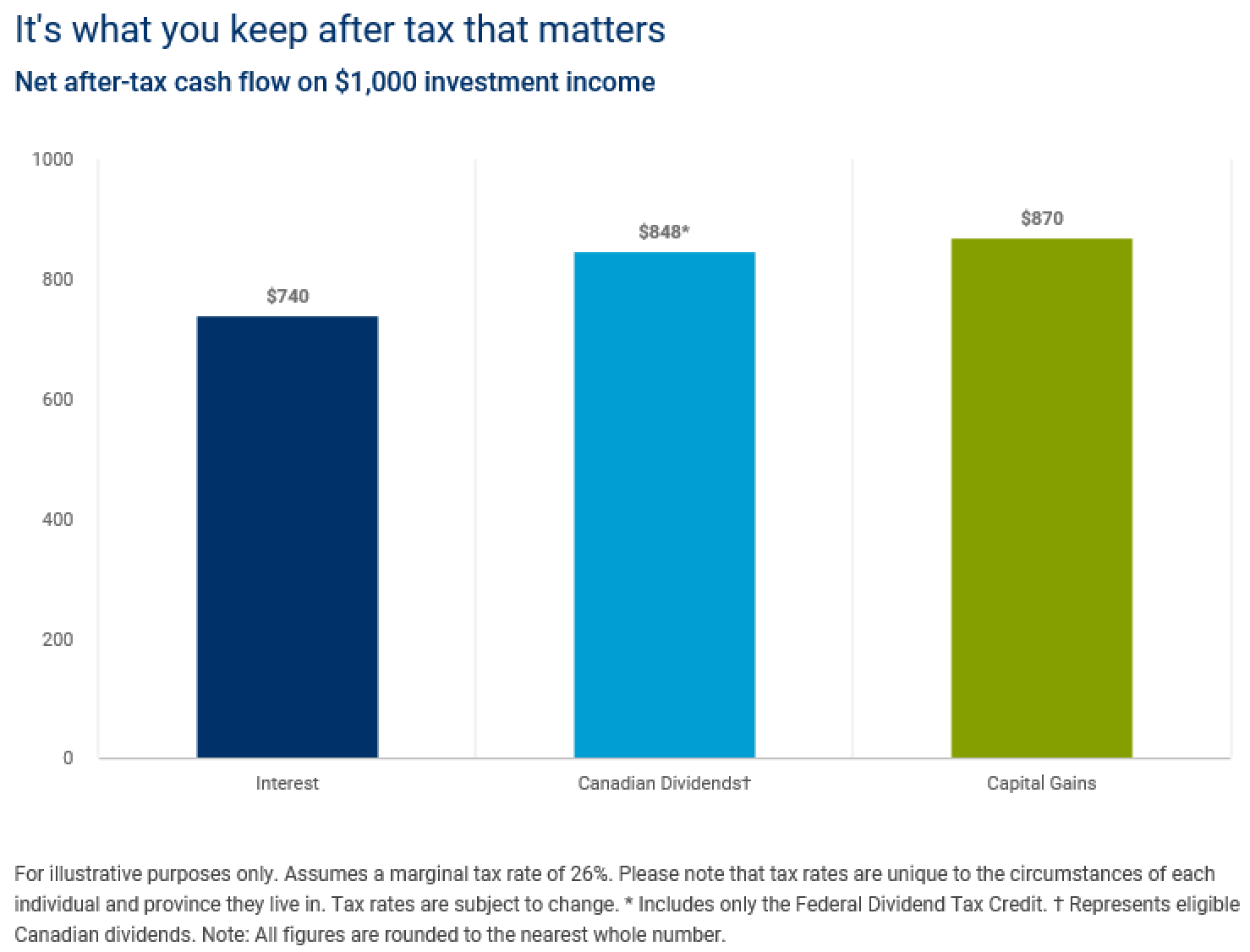

Whitehead Wealth Management Blog 11 Non Registered Accounts And Taxes

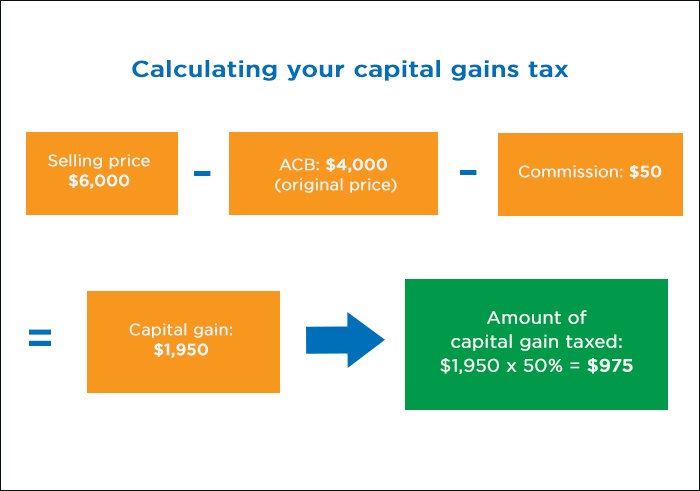

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Rate Of Interest On Gpf And Other Similar Funds Including Sds 1975 W E F 1st April 2021 For 1st Quarter Of Financial Year 2021 22 In 2021 Financial Fund Budgeting

Wfh And Your Taxes Wfh The New Normal What The Heck

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe